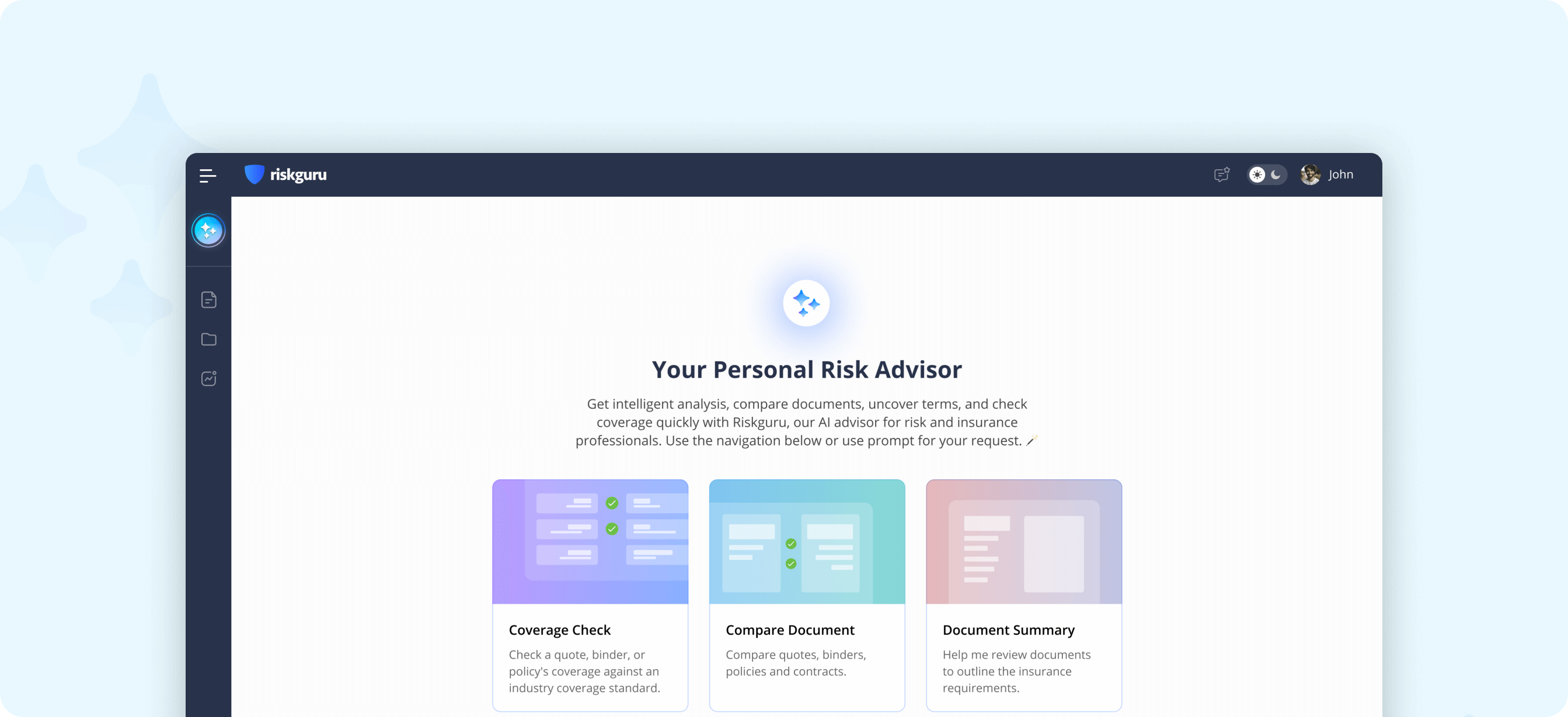

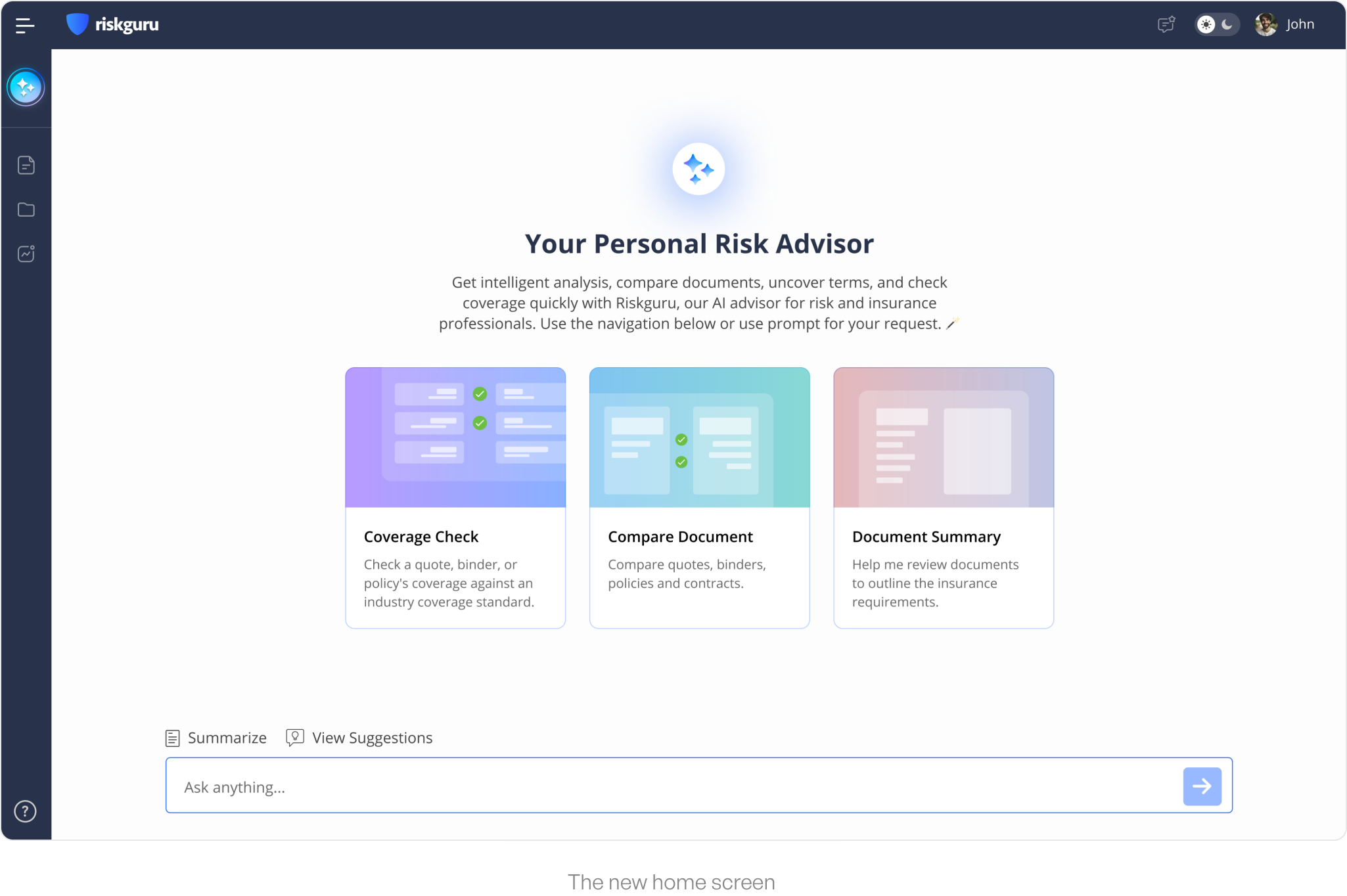

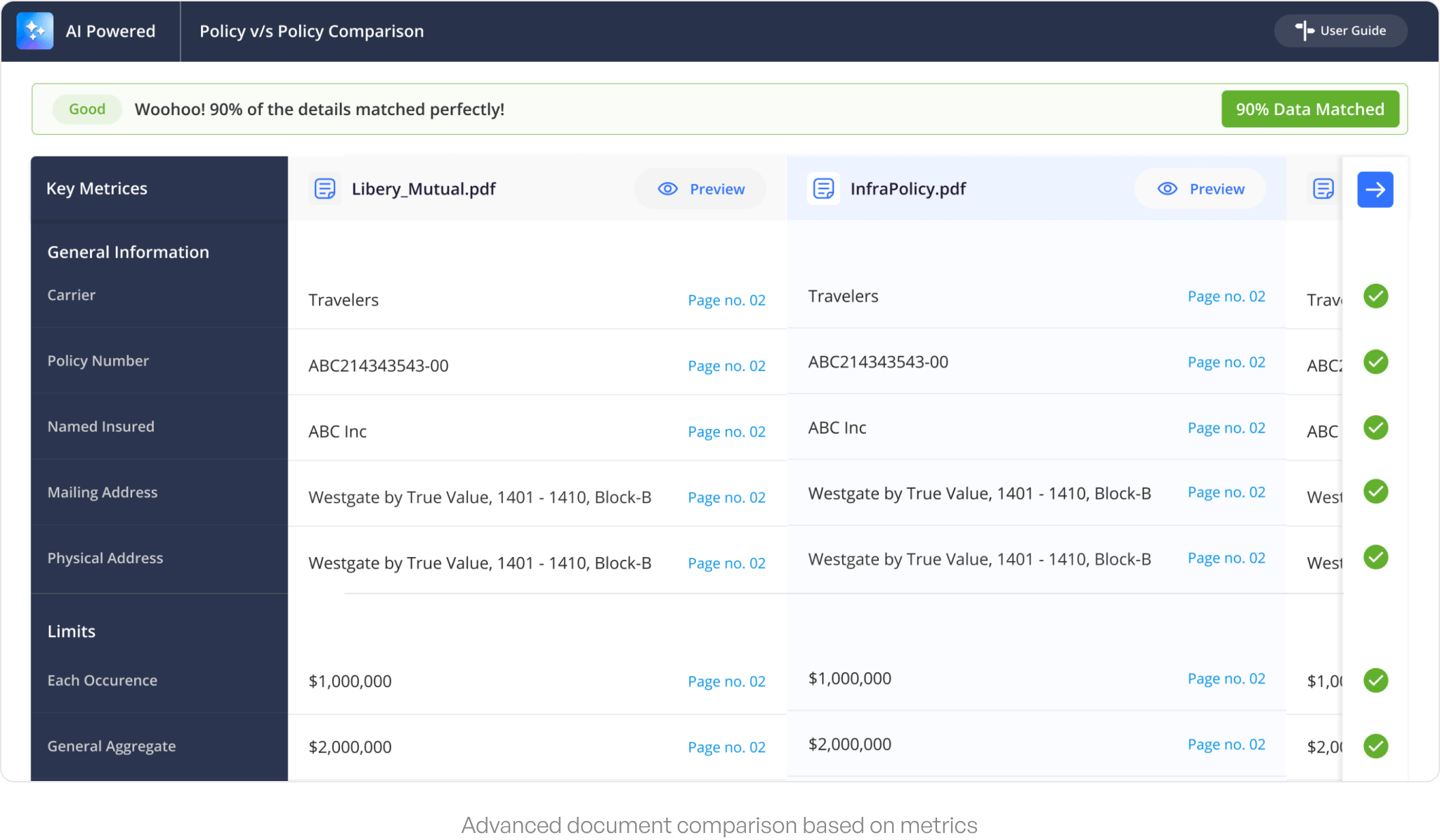

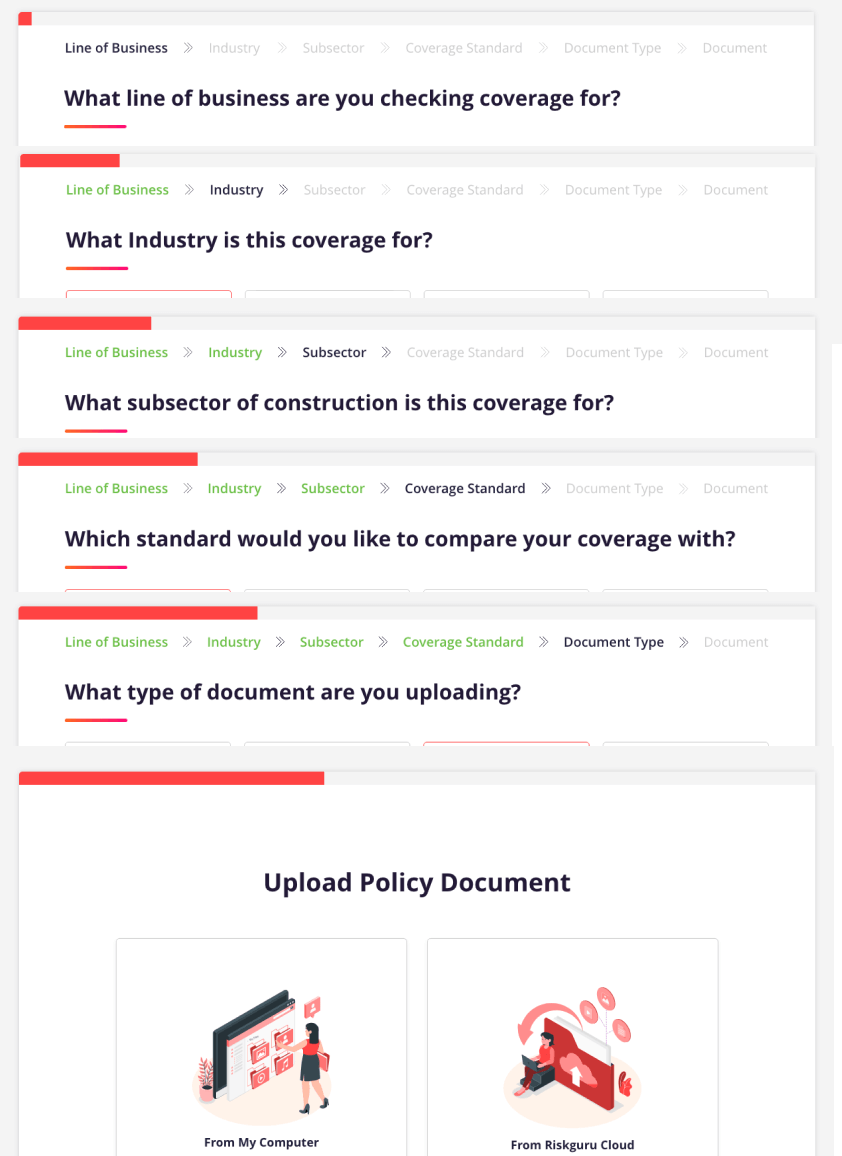

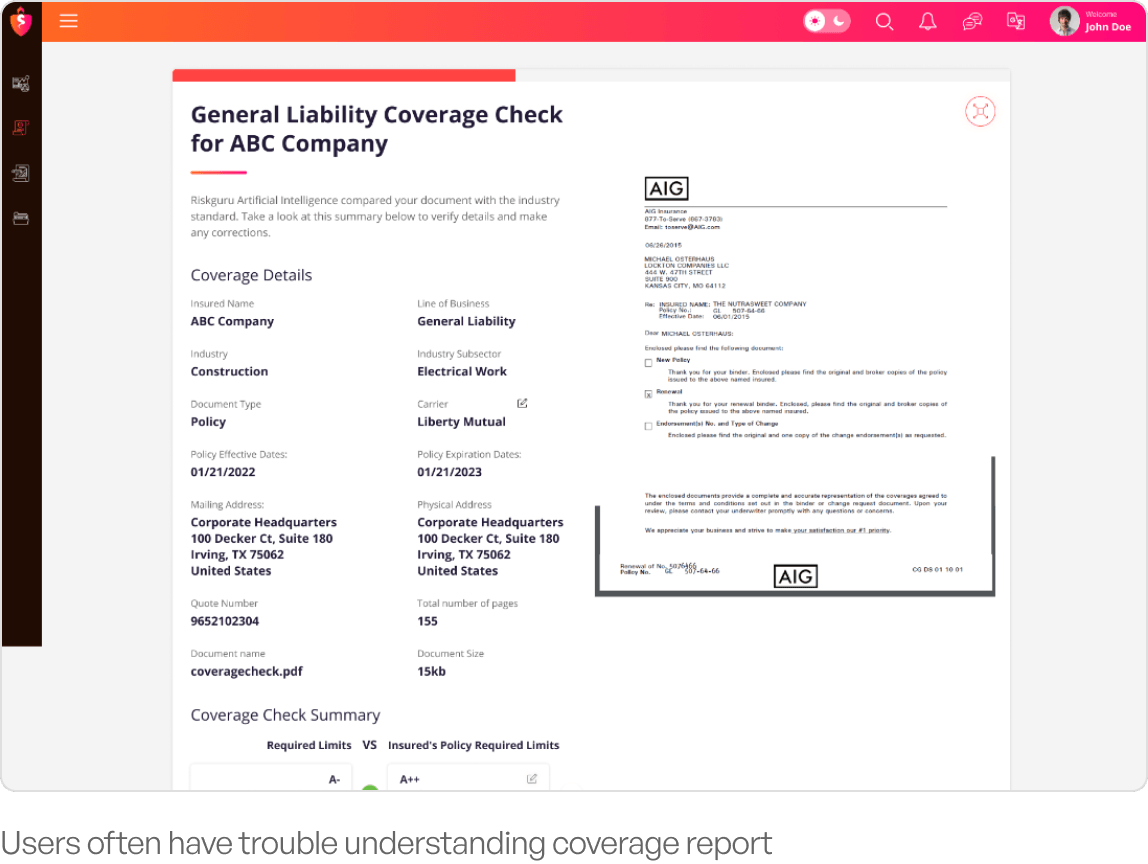

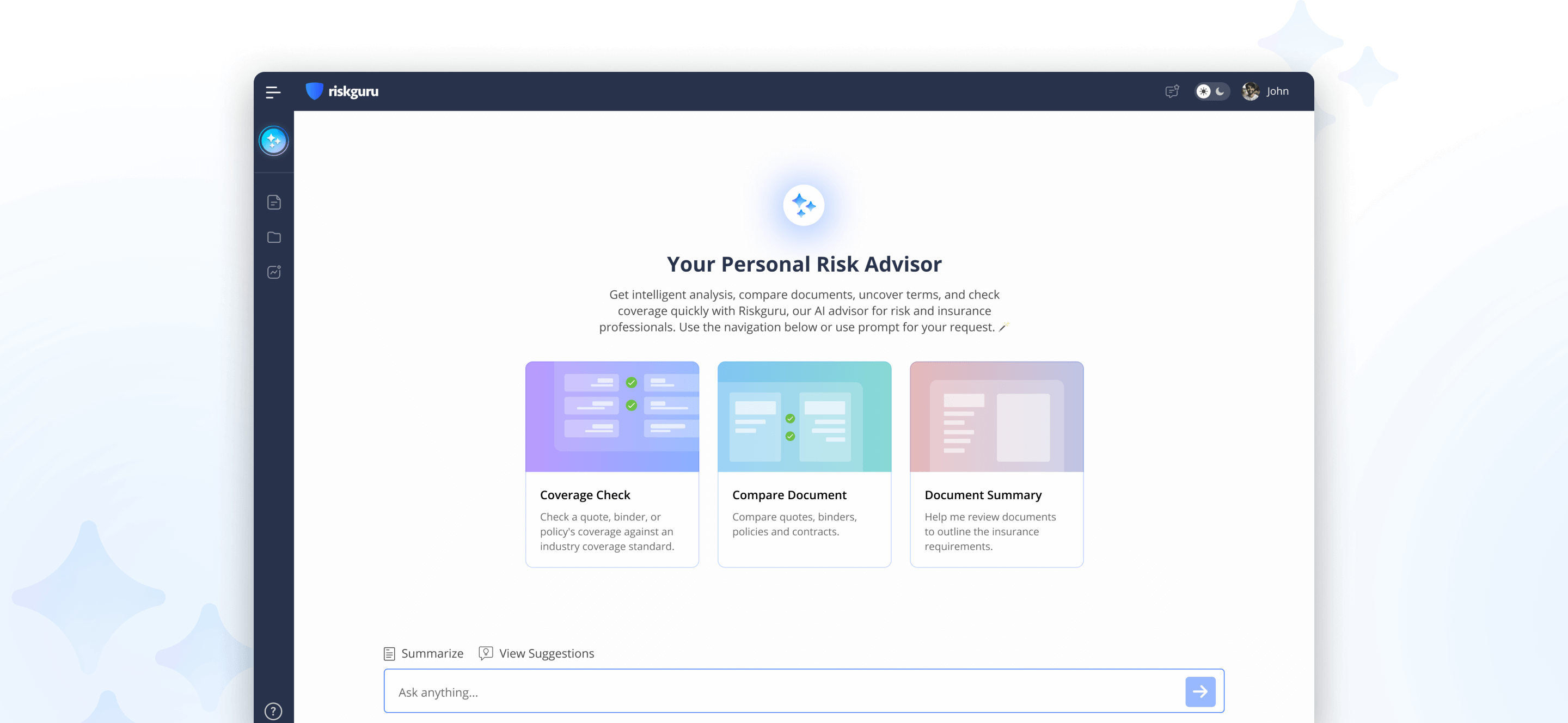

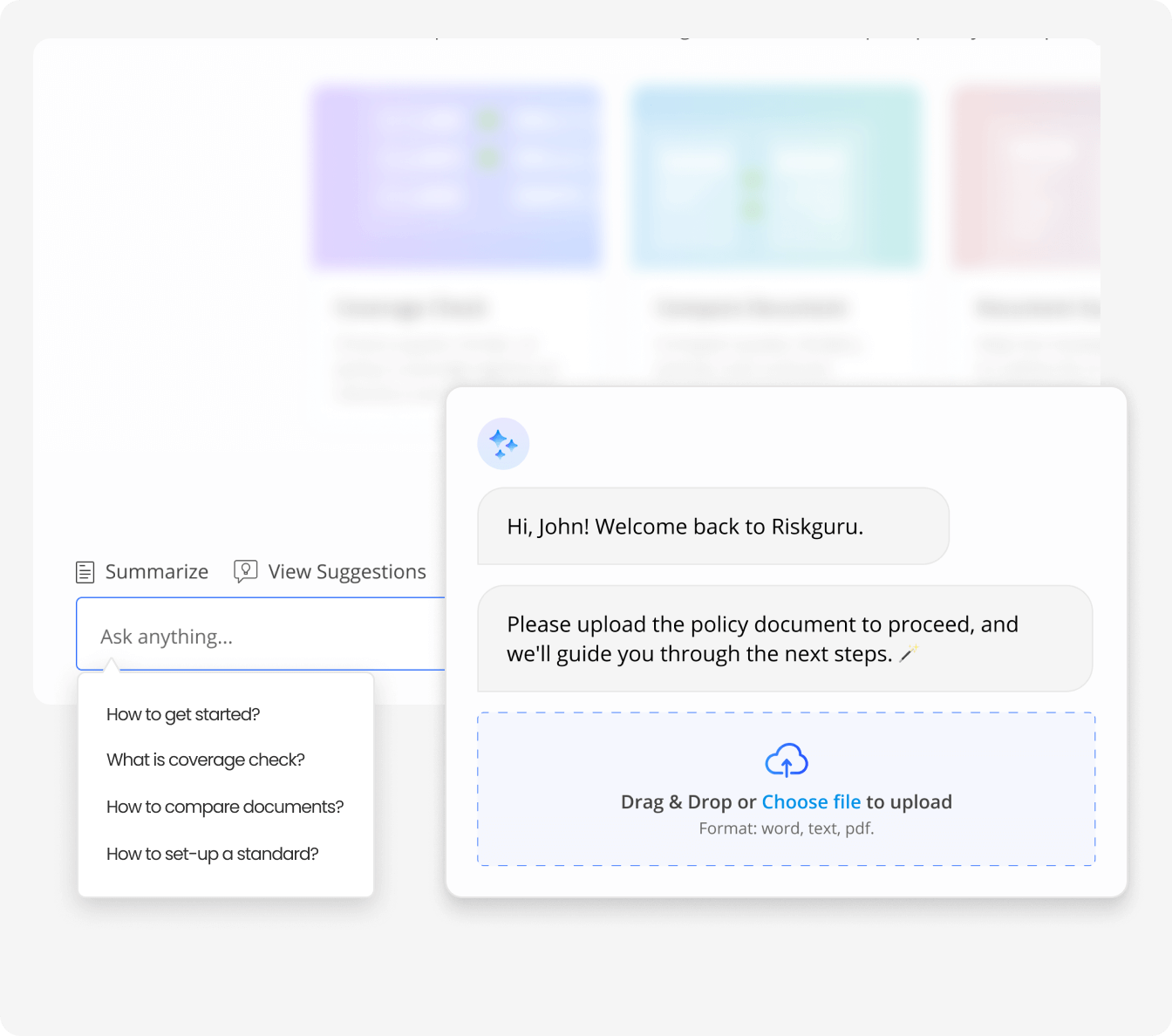

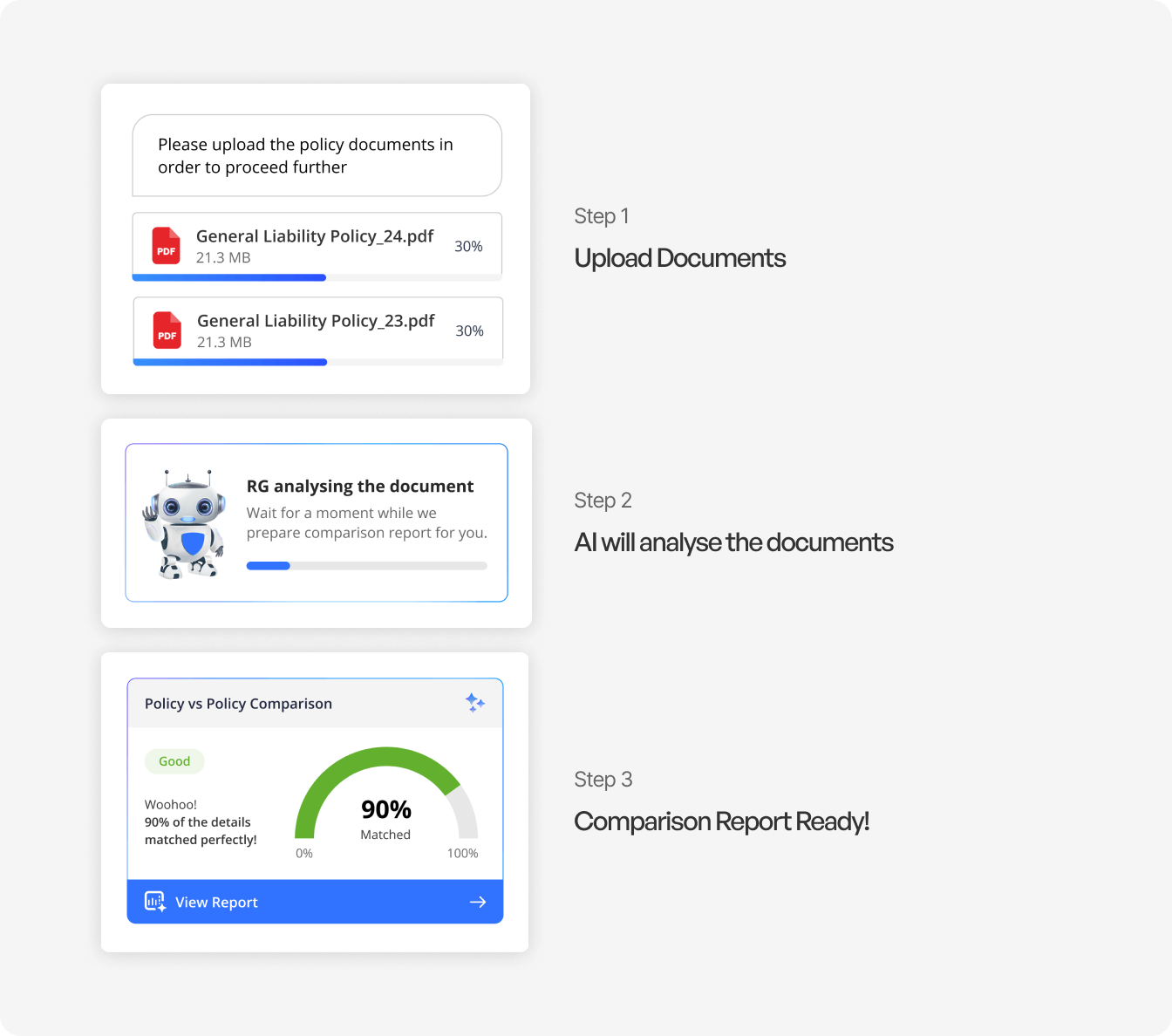

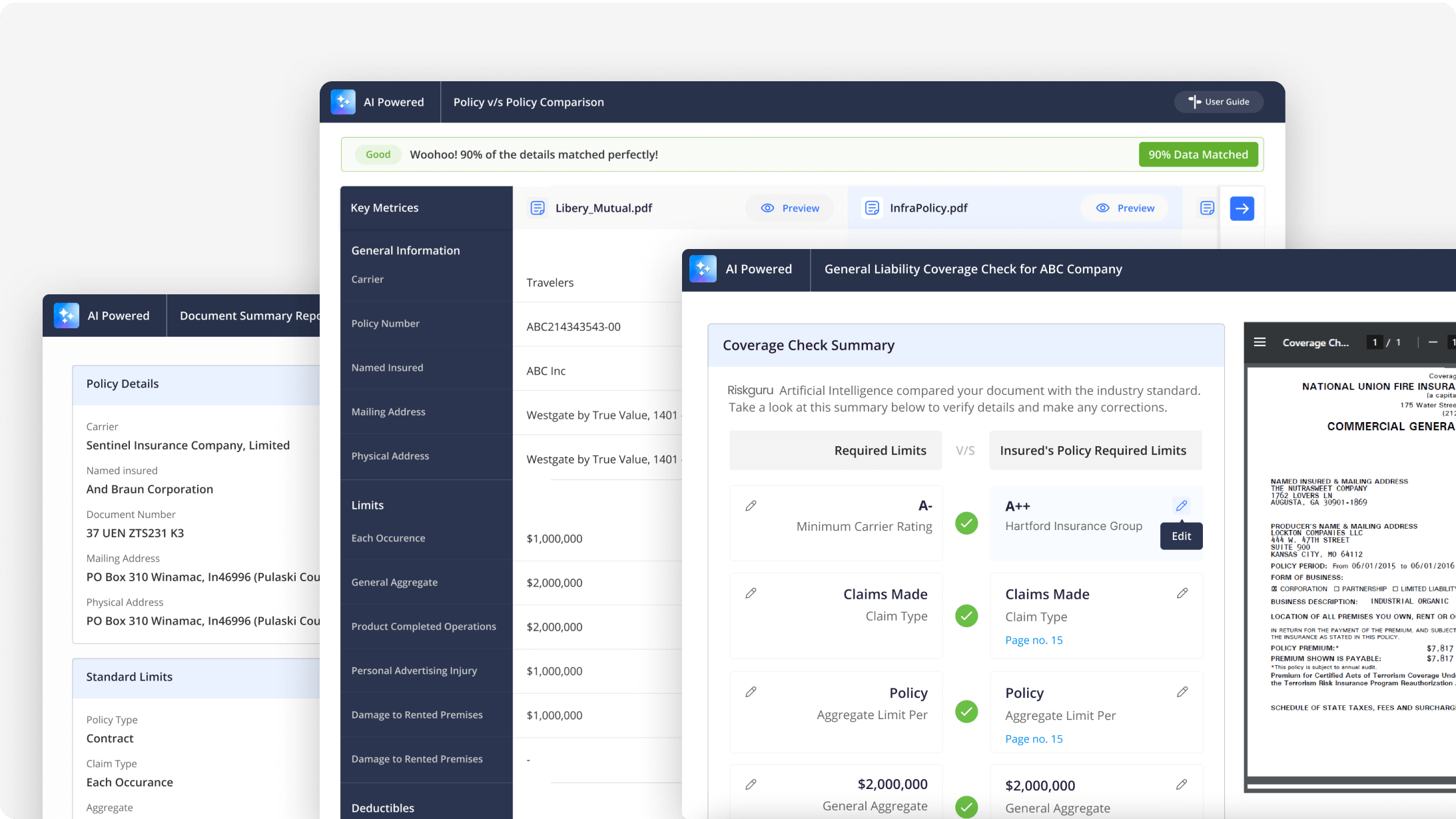

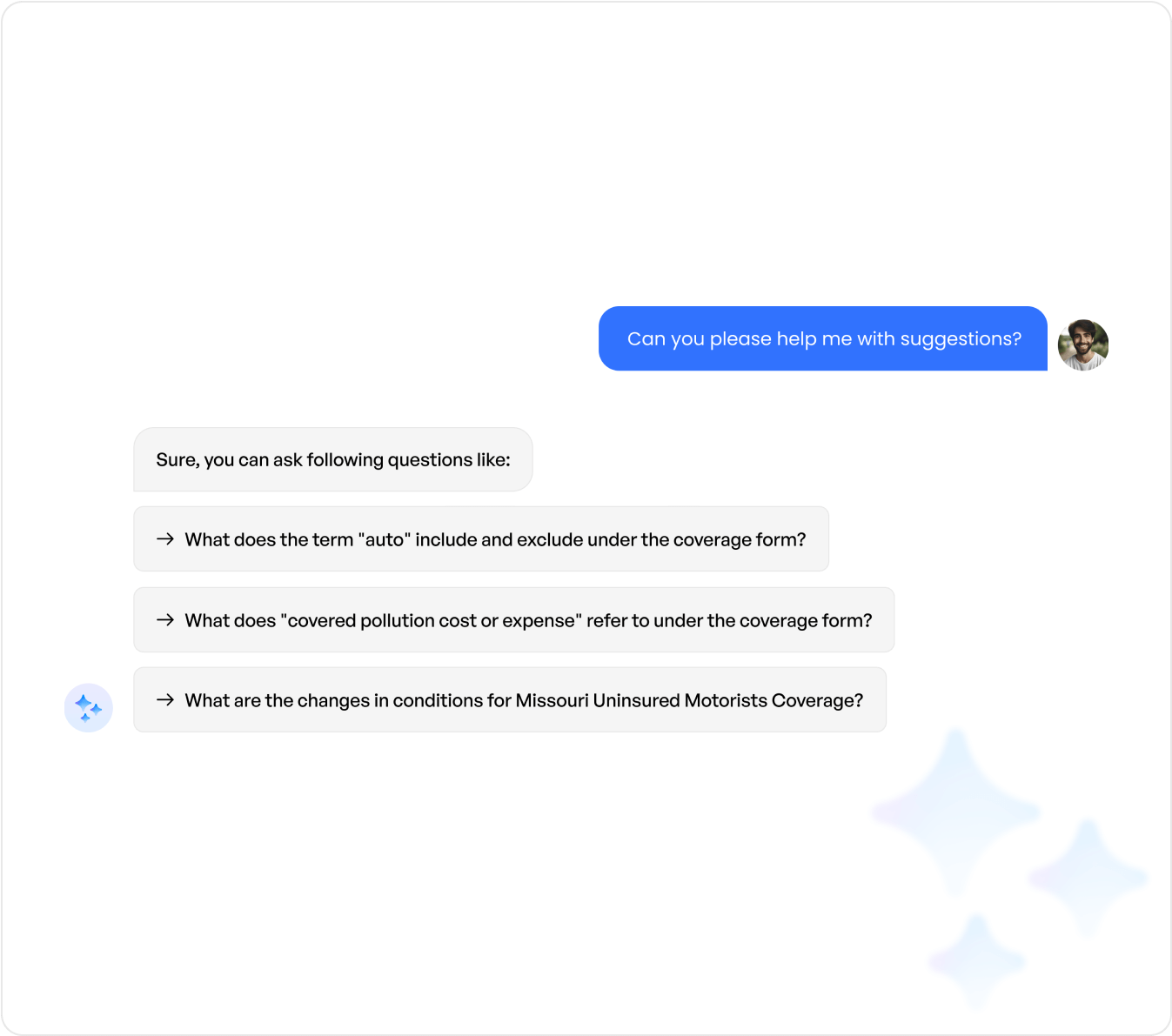

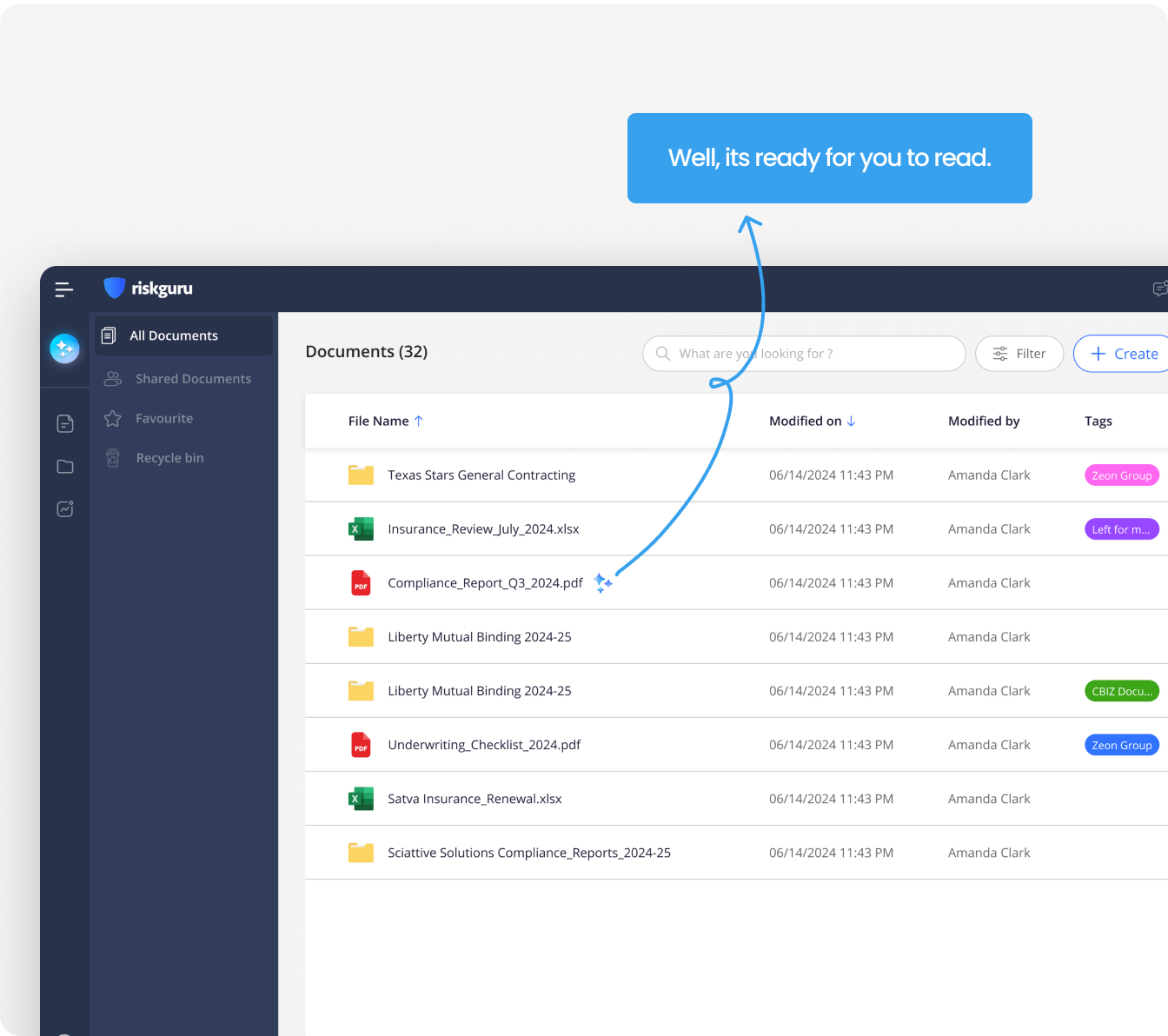

Riskguru is an AI-powered platform designed for the insurance industry, originally designed for document comparison. Over time, we expanded its features to include coverage checks, compliance reviews, and more.

As the features grew, the existing experience couldn’t handle emerging use cases and scale across diverse industry verticals. In 2024 we set out to redesign the product to make it a simple, delightful, modern system that works equally well for everyone.